Bitcoin and other cryptocurrencies are all the rage in the financial technology world right now. Observers have been intrigued with the earning possibilities brought about by mining, trading and investing Bitcoin. However, casual participants and bystanders wonder when all of the Bitcoin will be mined. And if this happens, what will happen to this cryptocurrency and its users? These questions regarding Bitcoin supply and mining will be answered in this article.

Bitcoin and other cryptocurrencies are all the rage in the financial technology world right now. Observers have been intrigued with the earning possibilities brought about by mining, trading and investing Bitcoin. However, casual participants and bystanders wonder when all of the Bitcoin will be mined. And if this happens, what will happen to this cryptocurrency and its users? These questions regarding Bitcoin supply and mining will be answered in this article.

What is the point of Bitcoin Mining?

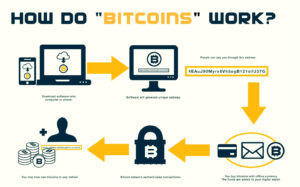

Bitcoin’s protocol revolves around the hashcash proof-of-work function. The main purpose of mining is to enable Bitcoin nodes to attain a consensus that is secure and tamper-resistant. Another purpose of mining is to produce or introduce Bitcoins into the system. This is made possible by paying miners transaction fees and new-coin-creation subsidy.

Bitcoin Supply is Finite

One of the characteristics of Bitcoin is that it is deflationary which means that mined coins are finite. The total number of Bitcoins that can be mined or unlocked is 21 million. To be exact, there are only 20,999,999.9769 bitcoins determined by the fixed point math used by the Bitcoin protocol. Once this amount is mined, the world’s supply of original Bitcoin will be virtually exhausted. This should be the case unless the protocol of Bitcoin is modified to accommodate a larger supply of Bitcoins.

Currently, there are approximately 17 million Bitcoins in circulation which is roughly 81% of total Bitcoins available for mining. This means that there are around 4 million Bitcoins left to be mined. Around 1,800 Bitcoins are generated every day. At this rate, the last Bitcoin is expected to be mined around year 2140.

Effect on Bitcoin Miners

Bitcoin miners are set to be directly affected when the supply of minable Bitcoins dry up. Miners thrive on the block rewards they receive for their mining work. However, they can still earn off transaction fees in order to continue operation. Some observers predict that miners will find this option less profitable resulting in a reduced number of miners. Moreover, this could lead to centralization of the Bitcoin network. This is a dire outlook since currency decentralization is the primary objective of Bitcoin and other cryptocurrencies.

Effect on the Price of Bitcoin

There are frequent fluctuations in the price of Bitcoin but the overall trend shows massive hikes in value especially in recent years. A limited supply brought about by a lack of minable Bitcoins could lead to an increase in prices. If Bitcoin becomes widely accepted in financial markets by the year 2140, when mining is expected to end, a scarcity in Bitcoins could result in even higher price surges.

Effect of Unaccounted for Bitcoins

The increased value of Bitcoin due to limited supply could be impacted by unaccounted for Bitcoins. There are inactive Bitcoins pegged at 1 million kept by the maker of the cryptocurrency, Satoshi Nakamoto. There are also lost or forgotten Bitcoins waiting to be rediscovered. Reintroduction of these tokens into circulation could lower Bitcoin prices.

In summary, Bitcoin supply is limited and could all be mined by year 2140 if current trends continue. This could greatly affect miners and the price of Bitcoin in the future.