Main Ideas:

- Stablecoins: the growth of decentralised money.

- The return of DeFi blue chips: revamping tokenomics, veTokens, protocol owned liquidity and DAOs.

- Gaming: how play to earn will continue to grow.

- Metaverse: will continue to grow, land and usage will begin, less speculation, users will dictate who wins out.

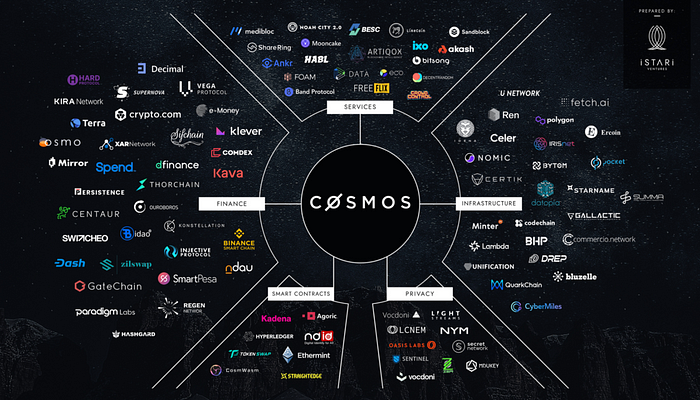

- Layer 1s and the fight for TVL. Consolidation > Growth, IBC gang.

- Options, Leverage, Perpetuals, Puts/Calls and all that wall street hedging stuff.

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

2021 Consolidation or Bull Market?

2021 was definitely a year full of growth for the crypto industry. Arguably it was the year of the alternative layer 1 chains. We saw some of the biggest growth from these. SOL/LUNA/AVAX were some of the most popular growing chains in the year but we can’t overlook the incredible growth from BNB and the Binance Smart Chain in the beginning of the year. Matic was also an early grower, and even though it is not an L1, I’ll count it, as it essentially functions as one.

2022 might be different as the intense growth on these chains has happened already and now it is time for the ecosystems to flourish and people will look for risk-free solutions and dApps.

On-Chain for the big boys (BTC/ETH) 2021 shows a slightly different story, mostly of accumulation rather than spending from the bigger players.

As big money enters the industry, we must also remember that time horizons are much longer. It is much more common for a VC to make a 2–10 year investment, than a 6 month investment. So 2022 might show us volatility and diversification into other types of assets, maybe stablecoin protocols that generate yield… more on volatility in 2022.

Stable, Stable, Stablecoins.

A decentralised economy needs decentralised money.

First, we must understand that stablecoins are the most traded asset in the crypto currency space. One might even say that this was even a stablecoin bull market. “According to the data, the stablecoin sector grew by 388% from $29 billion at the start of the year to over $140 billion at the end of the year, representing a record high.” — Ajibola Akamo

Stablecoin use has really exploded, partly because of DeFi and partly because of people looking for alternatives to volatility. Also, we have to consider people around the world that don’t want volatility (from crypto, or their own currency) so they look for USD alternatives to safeguard their wealth. I’ll cover the top 5 stablecoins and then some contenders worth mentioning.

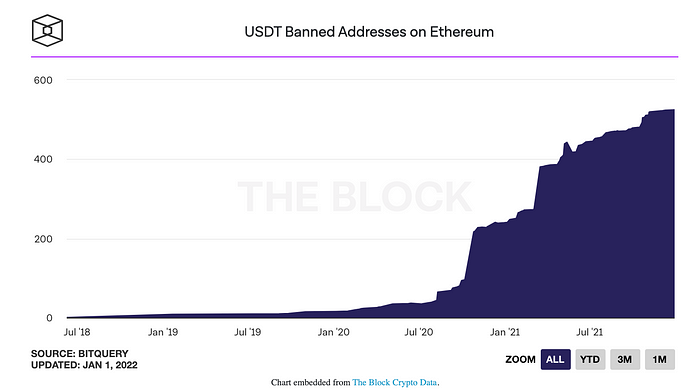

With stablecoins becoming such a dominant part of the crypto industry, it is important to understand what you are using and why. Lest we forget, decentralisation is one of the core principals of the crypto space. Right now, the biggest stablecoins are not decentralised. It’s so bad that Tether (USDT) can be frozen in your own wallet. Tether has a tendency of freezing assets, and even though I don’t approve of what many of these addresses have done (e.g. many DeFi hacks), freezing assets in your wallet defeats the purpose of “not your keys not your coins” since big daddy can always intervene.

“A Tether spokesperson told The Block that Tether regularly works with regulators for freezing addresses.” — Yogita Khatri

If you want more, just Google “tether freezes assets”. You can go down that rabbit hole. But I digress.

Next in line is USDC (backed by Circle), who is playing favourites with the US. This is the most likely candidate to start incorporating KYC addresses in order to transfer and use USDC. Yuck.

BUSD is the stablecoin used on Binance and the dominant stable on BSC — again, pretty centralised.

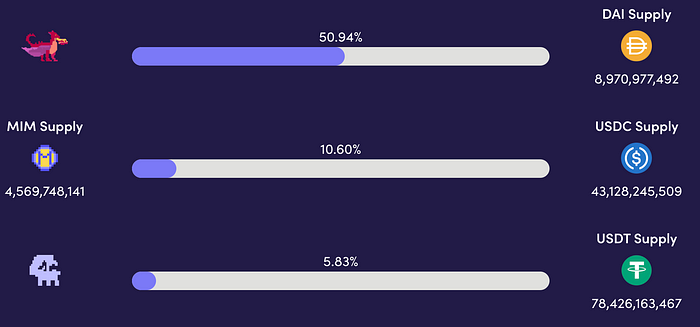

Now we get to the interesting part. In 4th place sitting at around 10B mCap is UST (terra). This is the top decentralised stablecoin currently. Many argue that this is a risky stablecoin as since it is an algorithmic stablecoin, it has no “backing”, but the mechanism has proven to work, and it is decentralised. Following a PoS mechanism through LUNA, all terra stablecoins are decentralised thanks to the Terra validators. To put it simply, burn LUNA → mint UST and vice versa.

UST has had impressive growth in 2021, starting the year at 185m mCap and finishing at 10B mCap. Huge growth. I expect to continue to see more growth from UST this year, as UST is adopted in more places, and the stability of the peg increases. In recent crashes we have seen other stablecoins loose peg while UST stays solid. UST isn’t the only terra stablecoin. As products like Chai App grow, other stablecoins will also grow and this will cause more LUNA to be burnt.

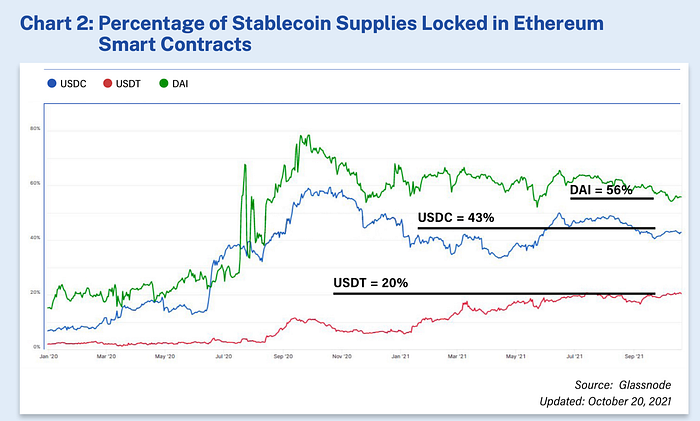

DAI is next. DAI is probably one of the older decentralised stablecoins (not so much anymore) and brought to you Maker Dao. Originally DAI was backed by ETH and would maintain its peg through some cool backing mechanics that MKR created.

However, nowadays the treasury includes USDC, which somewhat defeats the purpose of having decentralised backing. Furthermore, no one really has access to mint DAI. It is reserved to a few people. MKR has struggled too with providing value to the DAO. I’ll rank it as “best of the worst”. Furthermore, DAI isn’t on many exchanges so it makes it difficult to trade with, though it is currently the most used coin in DeFi, or at least on Ethereum, though this might be changing as we have some big projects playing catch up.

I’ll talk about DAI’s biggest competitor next: MIM (Magic Internet Money). You have to love the play on words that the team has done when they developed Abracadabra and the mechanism to mint MIM. MIM, like DAI, is a crypto backed stablecoin. However, anyone can mint MIM across many different chains. MIM has become one of the first cross-chain native stablecoins. The backing mechanism for MIM is pretty awesome too, as it uses yield bearing assets, so whenever you mint MIM you are essentially taking out a loan, but since your collateral is yield bearing, your loan is getting paid off as it remains open. This whole mechanism is governed by SPELL, Abracadabras governance token. Staking Spell gives you access to a share of the revenue generated by the platform, unlike MakerDAO.

MIM is currently at around 4.5B in mCap, but I expect this to grow as it becomes the cross chain stablecoin of DeFi. Also, DEX listings are starting.

MIM is the stablecoin of choice on chains like Avalanche and Fantom. The expansion continues.

Finally, I’d like to talk about FRAX. This is the first fractional-algorithmic stablecoin of which parts of its supply are backed by collateral and parts of the supply are algorithmic. Like UST and LUNA, there are two tokens to be aware of here. Frax, the stablecoin, and FXS (Frax Shares), the governance token which accrues fees, seigniorage revenue, and excess collateral value.

Frax is still small compared to the aforementioned stables with a mCap of around 1.8B, but I expect its growth to continue this year as there will be a migration to decentralised alternatives and Frax begins to deploy on other chains.

Stablecoins will be a huge part of the years ahead, so DYOR and choose wisely — the stability of your portfolio depends on it. Notable mention is SILK and Shade protocol, a private stablecoin using the same mechanics as LUNA.

Stablecoins will continue to be the backbone of many DeFi dApps and will be used in many ways, from generating yield, to farming, to providing liquidity and trading. This asset class is looked over for shinier things, but the US government is already making waves looking to regulate it.

Tying it all together I cannot miss the Curve Wars. I’ll summarise: Curve is the best place for people to earn yield on their stablecoins. CRV (the governance token for Curve) is used to vote on what pools get the most rewards. Protocols have been hoarding CRV so they can direct these rewards towards their users. Happy users → more TVL, more use of your stablecoin → your protocol grows.

Stablecoins will play a big role this year, and so will the best places to earn yield on said stablecoins. Curve is currently the biggest with 23B in TVL across 7 chains according to DeFi Llama. Convex is second in TVL. Convex is hoarding CRV in an attempt to control the gauge of rewards (see Curve Wars). But Convex is expanding… this segues to the next section.

The return of DeFi blue chips.

As hype and speculation settles down, we will see growth in protocols that have continued to build, add value, and have fixed their tokenomics.

One of the biggest problems for DeFi in the beginning was onboarding users. Users were bribed with incentives to move funds onto protocols, essentially giving away money. These incentives were detrimental to the protocols as they created selling pressure on the tokens as the emissions were sold by mercenary money. You see, protocols needed liquidity in order to operate. Not only liquidity for their own token, but also for whatever exchanges needed to be handled on the platform. This is where we got actions like the Sushi’s vampire attack, which stole liquidity from Uniswap so many months ago…

In comes Olympus DAO and “Protocol Owned Liquidity”, arguably one of the biggest innovation of 2021 in DeFi. Protocol owned liquidity solved many problems protocols faced when needing to bootstrap liquidity. Now token emissions can be minimal and projects can focus on building without devaluing their tokens.

Now, we have the next step: governance. With CRV, governance has mattered more than before since he who controls governance controls the money printer. This will continue to be a deciding factor as projects move towards that kind of setup. We are already seeing changes from YFI, FXS and some other protocols. This has created a migration towards veTokens (voting tokens) which will gain importance as those votes will directly affect the money used. Hence the rise of CVX and BTRFLY, these protocols are looking to offer “voting as a service”. They have already hoarded CRV and are moving into FRX and others. This ties back to the Curve Wars. I can’t overstate how important this will be moving forward, especially if we enter another crypto winter.

Now that we understand some of the biggest problems and some of the solutions in DeFi — protocol owned liquidity, value to governance tokens, reducing emissions, keeping users — what projects are doing something about this?

We have covered CRV, CVX, and I mentioned Olympus DAO, but I’ll dive deeper.

OHM is attempting to become like a ‘Central Bank’ of DeFi. Through their bonding mechanism, they have been able to grow a big treasury.

This treasury is then deployed to earn trading fees since they own 98% of their LP. Furthermore, Olympus Pro offers “bond as a service”, where they help other protocols own their liquidity. Each OHM token is backed by a basket of tokens. This means that the price of an OHM token can never trade below this backing value, but it can trade above that value.

OHM is helping projects like Alchamix reclaim their liquidity and make a comeback. Alchamix is the next protocol I’ll talk about. ACLX is a protocol where you can take out “self repaying loans”. You never run the risk of being liquidated, and don’t have a deadline to pay back your loan. The ACLX token suffered a similar fate to some of the other DeFi protocols but recently with its partnership with Olympus Pro, it has begun to make a comeback. Also, ACLX has a stablecoin you receive as your loan — alUSD. Watch for some growth here too. Whats cooler than a self repaying loan?

Abracadabra is the next one we will dive into. We have already stated that stablecoins are a big part of the future. Imagine if MakerDAO and Alchemix had a child. Abracadabra allows you to mint MIM with a yield bearing asset so you are essentially taking out a self repaying loan. Here you do have the risk of liquidation though, so please drink responsibly. Abracadabra is cross-chain and can be accessed from most chains out there. All the fees generated on Abracadabra are split with sSpell holders (staked SPELL). SPELL is the governance token here. By staking, you are essentially earning dividends from the platform.

Aave is making a move toward more institutional participants, and has also moved to patent its new code for V3 with MIT licenses. This would protect them from being fork in the first year. Even though crypto is an open source network, this would protect Aave from something like the Geist fork happening again as they were planning to move into the FTM ecosystem and Geist beat them to it. I think Aave isn’t done, but until we see some inner changes on tokenomics, it might not recover as much as the other protocols mentioned.

I haven’t had the time to dive into YFI, but I do know they reworked their tokenomics and thus the token price has since recovered. I wouldn’t overlook anything Andre Cronje works on but more on that later.

Finally, as special mention; Wonderland. Wonderland started as an Olympus fork, but has since evolved into more of a DeFi investment fund. The innovation here has been on how they are deploying their assets and their treasury management. Given the big numbers the treasury holds, it gives them access to early investment opportunities. Recently, they invested in a sport betting dApp. There is more to come from Wonderland and the work they are doing. Like most rebasing DAOs, its price has dropped, but the staking rewards are still high and the treasury has been growing as they have been active using the treasury.

I am looking for projects taking control of their tokenomics, lowering emissions, working to own their liquidity, and managing their treasury. Treasury mismanagement is what killed many projects in the last bear market. Whoever succeeds here will stick around in the long run.

Gaming: How Play to Earn will continue to grow.

In 2021 we saw the incredible growth of Axie as it brought to the spotlight Play to Earn gaming. Since then, many have tried but none has succeeded like Axie. However, their payout tokens (SLP) have been losing value like in most P2E games. Solving this is what will create an innovation in P2E games. Solve the tokenomics and you win.

One of the projects already solving this is DFK (DeFi Kingdoms) with their token JEWEL. DFK is a game, a DEX, a liquidity pool opportunity, and a market of rare utility driven NFTs. Yes, an all-in-one universe for you to play, earn and grow your pixelated avatar. Even though this project started on the Harmony ONE network, it is getting ready to launch on AVAX, attracting many more users. The JEWEL token has many utilities throughout the game so the price has actually continued to rise, even with it being a high emission asset. Don’t overlook DFK. Get your kid, nephew or little cousin to play for you if you must.

Next, RON. RON is the token for the Ronin chain — the chain that Axie migrated onto in order to avoid high gas fees on ETH. Ronin chain will be a gaming specific L2 on ETH. With the track record that Sky Mavis — the creators of the Axie Infinity — have, they will most likely continue to launch games, all running on the Ronin Chain. Do you want exposure to all the games launched by Sky Mavis? Ronin is the way to go.

There are many games in the works looking to launch this year or next, so I haven’t had time to dive into them all, yet. There are some things I will be looking out for in this sector though:

1- Playing mechanics: Is it fun? Can anyone play it?

2- Tokenomics: Is the token you are earning more than just a farm token you dump?

3- Accessibility: One of my biggest issues with games like Axie or Crabada is that you need an investment of around 2k just to get started with playing.

This needs to be solved in order to onboard users and to gain adoption.

4- Ecosystem and integration in DeFi: One of the breakthroughs with DFK was how they incorporated DeFi mechanics into the game. I believe this will be the future as people will P2E, and then be able to grow their earnings. This creates more reasons to stick around in the game. Imagine if your bank had a fun game to manage you savings account. — Gen Z unlocked.

Metaverse, hype?

The crazy hype ever since Facebook rebranded to Meta sparked a rally in all of the crypto metaverse sector. In my opinion, the only ones worth watching at the moment are SAND and MANA, but SAND takes the win. The total daily active users on Decentraland is around 2900 — Source.

This is less users than most games out there and pretty low numbers even for a crypto game. Conversely, The Sandbox’s user base in 2021 has grown five-fold, reaching 500,000 wallets. It also has over 30,000 monthly active users, about half of whom spend more than an hour per day on the metaverse — Source.

In a crowded environment full of metaverse narratives where Zuk holds a team meeting with everyone in full avatar getups, the metaverse with the most users wins out. This also leaves room for the Facebook (Meta) metaverse, though I do believe they will lean more into their hardware (Oculus) and then let people explore other software options as most software companies do not have the capital to compete with the hardware needs and Facebook will probably try to buy some metaverse company anyway…

SAND will win out in my opinion because of the game(s) being developed. It appeals to a wide audience and is a better alternative to Minecraft or Roblox.

Metaverse is overhyped. Take a step back to P2E and decent gaming mechanics. Solve that and your metaverse will see people flock to it.

I still don’t know anyone that told me “I toured an NFT art gallery on Decentraland this weekend”. Until I see even the most niche crypto personality say that, the meta verse is overhyped. Thanks Zuk.

Digital Real Estate: The reason that this might not be a bad investment is because of the opportunities you have on the land you own in the metaverse. However, unless you are a developer and plan on doing something with your measly small plot (few can afford something decently sized), you will just be sitting on a small empty plot until your neighbours do something worthwhile. But think about it… why would anyone pay to visit your plot while they can just go to the Atari plot next door and play a game that was actually developed by ATARI. Trade them, don’t date them (unless you plan on developing something cool).

All in all, tracking users will be the clearest sign on who the winners will be. Forget about price action, focus on users. This is what Axie had even a year before we all heard about it. Find the gamers, not the “investors”.

Layer 1s and the IBC Gang

In 2021 we saw SOL/LUNA/AVAX grow. Not only them, but also BNB and Matic. I already talked about this in the introduction so I won’t expand. If we are entering a bear market, typically, the biggest movers up also move aggressively down. However, with the beauty of users and things to do nowadays on these networks, I don’t think we will see the lows of 2018 unless we see a mass exodus of users and funds from these chains. Furthermore, Luna might be protected by the continued growth of UST and the other terra stablecoins, so the Luna burning mechanism will help it by reducing supply.

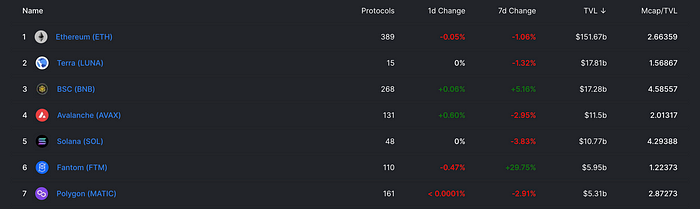

We are definitely seeing a migration into other L1 solutions. Whether this is just mercenary money looking for better yields or speculators looking for the next pump, is yet to be seen. As these ecosystems settle, it is important to see who can retain their users, and who was just there to squeeze the lemons dry. Will TVL stick around or will it move on to the next shiny object? We are already seeing SOL slow its growth, but LUNA and AVAX have retained users (even grown) as the price has trended down. If they can keep their userbase, it bodes well for the longterm vision of these projects. Continued innovation and launches of protocols on these platforms will be key — especially protocols that benefit their users.

Now let’s see what can still grow, or who might play catch up. On the radar are Fantom, Harmony, Atom, and Secret. All of these chains offer something unique.

During the dip in the beginning of the year, we have seen these assets show relative strength and outperform. The question is: is this marking a trend for the year? Some might argue yes.

Starting with Fantom, it offers a different scaling and consensus mechanism to other PoS chains. Furthermore, it has one of the biggest builders in the crypto space focusing on developing there — Andre Cronje. Don’t overlook Andre, he is arguably one of the biggest developers in crypto and he is now working on a new project along with Daniele Sestagalli set to be launched on FTM. If innovation continues on FTM, the growth of the ecosystem will continue and so will the price of FTM.

Looking at TVL, FTM sits in 6th place just before Solana, I wouldn’t be too surprised to watch TVL pass that of Solana in the near future as more continues to be launched on FTM, and users are growing. Just look at the 7-day growth in TVL. Something is lurking and I don’t want to be caught flat footed when the ship decides to start moving. Yes, its already moving, but no turbo yet…

Harmony ONE is another token that has been doing well. The team has been mostly focused on building and it is currently one of the fastest and cheapest networks to use. However, there aren’t yet that many things to do on Harmony, the only real option being DFK. So until we see more growth in the space, the value offered is mostly speculative. It’s worth monitoring for any new launches happening, since DFK was such a huge success.

Finally, ATOM and the IBC gang. IBC stands for Inter-Blockchain Communications. This is the core of ATOM, connecting the multi chain ecosystem of blockchains through IBC. Even though this seemed farfetched a year or two ago, this idea seems to be coming together finally as many ecosystems have grown using the Cosmos SDK and are now interconnected through IBC. I believe this year we will see the expansion of these ecosystems. In 2021 we saw LUNA and BSC grow form Cosmos SDK and incorporate IBC in the later part of the year. Many more projects have launched since then or have added IBC and are now ready to be interconnected. Secret is one of them.

Secret is a privacy-first smart contract platform where most data is protected. Contracts work in a permissioned manner where you limit the information you share with the protocol you interact with. A quick example is proof of age: you don’t need to show the bouncer your ID with all of your personal details, you just show proof of age and then are let in. This protects your private information while also complying with the KYC requirements of the protocol or business you interact with. Simple, sweet, savoury.

This extends to other areas too, NFTs for example. A big project that launched recently was the Tarantino NFTs, where only the owners got access to private information in the NFTs. This has led to some controversy and Miramax is suing. However, they can’t prove there is a breach of contract since they can’t see the info on the NFTs unless they themselves buy an NFT. Fun.

I believe as the world develops, more people will look for online privacy, and Secret solves this dilemma. To add the cherry on top, the launch of the Shade protocol with their stablecoin SILK adds another level of privacy to payments.

Imagine if LUNA and Monero had a baby.

There are many other protocols launching on IBC and I don’t have the time or headspace to research them all. Notable mention is OSMOSIS, an IBC DEX, which is fast growing. Osmosis allows for cross IBC exchanges with minimal fees, so you can use, for example, ATOM to buy LUNA, or LUNA to buy SECRET. The game changer will be once they are able to launch native BTC on the IBC network. This will allow the boomercoin BTC to enter and add another level of accessibility in DeFi.

Though 1B in TVL is peanuts compared to some of the other protocols out there, it gained this quickly. There is still room to grow especially considering this is a cross chain DEX. Find more about all the projects on the Cosmos IBC network here.

Options, Leverage, perpetuals, puts/calls, all that wall street hedging stuff.

I’ll wrap up with some of the most underdeveloped areas in DeFi. For a quick perspective, there were over $467 billion traded in options every day in 2021 for stocks. When it comes to buying and selling stocks, the number was only ~$410 billion. For the first time ever, options activity has exceeded that of stock trading — Source: Money with Carter .

Options and other contract solutions will continue to grow in DeFi. At the moment we have protocols like DYDX where you can trade with leverage on DeFi. DYDX has had more trading volume some days than that of Coinbase even. Another option is Dopex. Dopex is a decentralised options protocol which aims to maximise liquidity, minimise losses for option writers and maximise gains for option buyers — all in a passive manner for liquidity contributing participants.

There are a number of other projects out there looking to solve this problem. SushiSwap is set to add leverage soon using MIM and making it cross chain compatible. We shall see when it happens but with Daniele Sestagall now at the helm I think we will see launches resume. Whoever can get a proper protocol for options, leverage and contracts will quickly gain traffic. I’m personally thinking that Andre Cronje and Daniele Sestagall’s secret project will be something that solves this.

This is a space I have had little exposure to but I will be looking to learn more about it in the coming weeks.

Conclusions, next steps.

Wrapping this whole rant up, I’ll summarise some steps I’m looking to take with my own portfolio. The projects I am looking to gain exposure to this year are (in no particular order or weighting): LUNA, FXS, SPELL, SCRT, FTM, ATOM, OSMO, JEWEL (CRYSTAL on AVAX), DPX, RON, CRV, CVX, BTRFLY, OHM, TIME, and ACLX.

Most importantly, I am looking to set up my portfolio to farm most of these tokens, reducing risk. I will consolidate onto Stablecoins and look for the best farming strategies out there.

Some options at the moment are: Anchor 19.5% interest on UST, and Level 2 is using Abracadabra’s UST degen box, up to 90% APR on UST. This is currently only available on ETH but is launching on FTM soon. Next, using the Spectrum Protocol auto compounder to earn around 50% APR. I’ll be looking for solutions to use options contracts on Dopex to capitalise on volatility in both directions as the market chops. I will venture into other DeFi options on FTM and play DFK. This year will have more volatility so I will be looking to consolidate into more stable solutions take out less leverage and loans, and focus on using the protocols out there that are working. I’ll be using part of the portfolio for rotating into sectors that are outperforming. Look for waves: Metaverse/NFT →DeFi →L1s →Storage →Oracles → etc…

All in all, what I am looking for this year is: active users, TVL, usability and stable growth. Think of it as the “consumer staples” for the crypto industry.

I want to walk a fine between the degenerate strategies and the boomer bonds. I’ll look for growth while mitigating the downside as much as possible.

Be well.

Xulian

Twitter @KingJulianIAm