Cryptocurrency taxes can be a sticky subject. The question of whether you should report your crypto trades for tax purposes can be debated into eternity. You will get different answers from everyone, and a lot of different factors come into play. This post is not meant to convince you one way or the other – it is meant to be a tool that provides clarity and education to those who do indeed want to report their crypto trading gains on their taxes.

Cryptocurrency taxes can be a sticky subject. The question of whether you should report your crypto trades for tax purposes can be debated into eternity. You will get different answers from everyone, and a lot of different factors come into play. This post is not meant to convince you one way or the other – it is meant to be a tool that provides clarity and education to those who do indeed want to report their crypto trading gains on their taxes.

It’s important to note that much of this content will be centered around how the US treats cryptocurrency taxes, though much of what is discussed will be also applicable in other countries.

Let’s start with the basics.

Cryptocurrency is Treated as Property

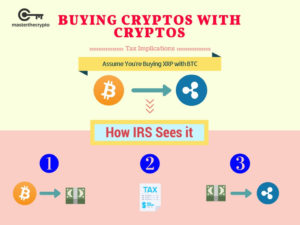

According to the IRS guidance that was issued in 2014, cryptocurrencies should be treated as property for tax purposes, and not as currency. This means that the trading of cryptos like Bitcoin, Ethereum, Ripple and almost all other alt-coins must be treated in the same way as other forms of property (stocks, gold, real-estate). Because crypto is treated as property, it is subject to capital gains taxes. Boiled down, you incur capital gains whenever you sell property for more than you purchased it for. You then report this gain on your yearly taxes, and that’s the end of it. The same is true for cryptocurrency taxes.

Reporting Capital Gains

This means that you would report a capital gain made on crypto in just the same way as if you traded Apple stock for Microsoft stock for more than you originally paid for it. So for every trade that you make, even if it is just a coin-to-coin trade, you need a few basic pieces of information. You need to know your Cost Basis (the original value of the crypto when you acquired it), and you need to know the Fair Market Value of the crypto at the time of the trade. Once you know both of these things, calculating your capital gain is simple. Simply subtract the Cost Basis from the Fair Market Value. Let’s look at a quick example of how to calculate cryptocurrency taxes, to make sure this makes sense.

Let’s say you purchase $100 worth of Bitcoin including transaction and brokerage fees on April 1st. That $100 currently buys about 0.01 Bitcoin. Now let’s say that two months later on June 1st, you trade all of your 0.01 Bitcoin for 0.16 Ether. Well at the time of this trade, 0.01 Bitcoin had gone up in value to $160. $160 is the Fair Market Value, and $100 is your Cost Basis. This makes your capital gain on the trade equal to $60. You will report this $60 gain on your IRS form 8949. Repeat this process for all of your trades, and report the gains and losses from each trade on separate lines of the 8949 form.

I know what you’re thinking, how in the world am I supposed to calculate the cryptocurrency taxes for every single trade that I’ve made over the past year? We have heard this same problem over and over from high-volume traders in our community. Some people are making hundreds of trades every single month and a lot of them haven’t been keeping track of the Fair Market Value of their coins at the time they traded them. In this case, accurately calculating your capital gains can quickly become an excruciating if not impossible task. That’s why we are excited to be partnering with CryptoTrader.Tax, which is a service that automates this entire process.

Cryptocurrency Taxes Made Easy

CryptoTrader.Tax aims to make cryptocurrency taxes easy, and the process is quite easy indeed. You simply import your trading history from the exchanges you trade on. From this, they will generate your complete IRS form 8949 as well as an “audit packet” that details every single calculation used for your net cost basis and proceeds. The packet includes an income report, short and long term sales report, and closing positions report. These generated reports can be uploaded into TurboTax, given to your tax professional, or simply used to complete your yearly taxes.

Our mission is to be the #1 resource for beginner and experienced crypto traders. To align to that mission, we are continually trying to provide the best tools to our community that allow them to maintain consistent trading success. If you want to learn more about CryptoTrader.Tax or about how to report cryptocurrency on taxes, checkout their website here.