Bitcoin, created in 2009, is known as the first cryptocurrency made available to the public. Other cryptocurrencies made following Bitcoin are often called altcoins or alternative coins. A cryptocurrency is a digital currency which utilizes encryption methods to control the generation of currency units and verification of fund transfers in a decentralized, borderless manner. Bitcoin is often referred to as “digital gold.” There are many ways that Bitcoin and gold are similar. This article discusses these similarities and the importance of their comparison.

Bitcoin, created in 2009, is known as the first cryptocurrency made available to the public. Other cryptocurrencies made following Bitcoin are often called altcoins or alternative coins. A cryptocurrency is a digital currency which utilizes encryption methods to control the generation of currency units and verification of fund transfers in a decentralized, borderless manner. Bitcoin is often referred to as “digital gold.” There are many ways that Bitcoin and gold are similar. This article discusses these similarities and the importance of their comparison.

Gold is a chemical element with the atomic number of 79. Gold is a heavy metal that is highly malleable and ductile. Historically, this precious metal has been highly sought-after for its rarity and uses such as in currency and jewelry. First known use of gold coins dates back to 600 BC by the Turks. Bitcoin, on the other hand, has only been in use since 2009 when the first open-source client was launched and the first bitcoins were issued.

Mining

Both Bitcoin and gold are introduced into circulation after mining. Gold is literally mined through various ways such as placer, hard rock, byproduct and gold ore mining, producing hundreds of tons of gold each year. Meanwhile, Bitcoins are “mined” by “miners” using specialized computer hardware. Bitcoin miners process transactions and secure the Bitcoin network in exchange for bitcoins. This time- and resource-intensive digital work is also comparable to actual mining of gold due to their difficulty.

Scarcity

Gold is a rare precious metal; there are only around 187,000 tons of it in the world. Most of this mined gold is stored in government and international financial institution gold reserves. In comparison, the total number of Bitcoins is set at 21,000,000. This scarcity increases the value of Bitcoin over time, hence the comparison.

Value

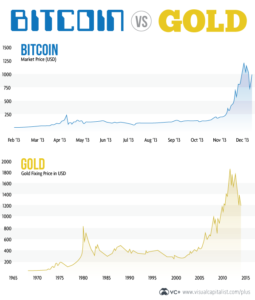

Gold is used as an international store of value and can be bought or converted into any currency. Gold also has similar value all over the world thus it is easy to convert into cash. Gold prices have reached $1,348 in 2017. Bitcoin, on the other hand, have seen steep fluctuations with some prices at times higher than gold. The advantage of gold over Bitcoin is that the former has a physical form and use while the latter lacks both. Therefore, gold will have a baseline value whatever happens in the international markets. Bitcoin could also acquire an indispensable use and baseline value in the near future if it gains wider acceptance. Currently, both are ideal stores of value as indicated by their vibrant markets.

Means of Payment

Gold has a long history of being a means of payment. Although the increase in price of gold is not exponential, its value constantly rose through time because people believe in it. This is an important criterion for a form of payment. Users of Bitcoin also believe in this cryptocurrency, thus its value remains and people accept payments in its form. Already, Bitcoin is being used as currency for many types of transactions around the world. It remains to be seen if more governments will eventually accept Bitcoin as a currency which will greatly improve its universal status as a means of payment for goods and services.

In summary, gold and Bitcoin share many similarities. Both are presently highly valued by their users. Based on current trends, it is reasonable to refer to Bitcoin as gold’s digital equivalent.