Is Cryptocurrency still worth pursuing for Entrepreneurs in Legal Cannabis?

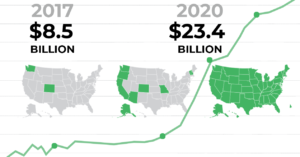

Cryptocurrency and the marijuana industry have worked hand-in-hand the past four years, with high hopes for cryptocurrencies like Bitcoin, Dash and Monero to provide a business solution where banks cannot. Yet while the marijuana industry continues to boom, Cryptocurrency faced a huge drop off in popularity after the 2017 bull run ended. The excitement of cryptocurrency investment wore off when casual investors lost 80% of their value after buying in at near $20,000 USD values. Prices endured a slow drop to under $3,200, with many investors still asking “when will Bitcoin hit its bottom?” Nonetheless, the top 3 most popular cryptocurrencies have a staggering $96 billion dollar market cap worldwide. Meanwhile, the worldwide legal marijuana trade was worth $9.5 billion in 2017 (Forbes.com), with the U.S. accounting for 90% of that figure – and the market is still growing. The marijuana industry is projected to reach over $24 billion in the U.S. by 2025. But since 2017 the excitement about cryptocurrency and cannabis working hand in hand has died down significantly. Entrepreneurs and consumers are left asking themselves if there is still a place for cryptocurrency in the business of legal cannabis?

Problems Faced with Crypto and Business

Volatility in the world of cryptocurrency has always been a concern for business owners. As a highly speculative asset, the price of cryptocurrency is supported by news bubbles, hope, and trends in the charts. For investors that are keeping a close eye on things, this volatility is a fantastic way to make a profit, but for the already busy entrepreneur, accepting cryptocurrency can be a headache.

In theory, cryptocurrency would be an appreciating asset, rather than a depreciating asset like fiat (see governmental policies on inflation). But since the market has not shaken out a clear winning coin in terms of real world value, it is difficult for business owners to keep up with which coin they should be accepting as payment without fear of quickly plummeting values.

Add a lack of integrated POS systems, unclear guidelines on cryptocurrency taxation, and general lack of understanding of cryptocurrency, and it would appear that there are too many barriers to straight-forward cryptocurrency business integration.

How Banks are Failing the Booming Marijuana Industry

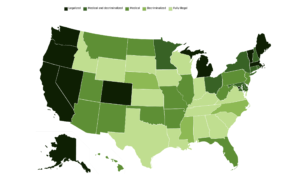

Despite some integration and policy shortcomings, cryptocurrency still has potential to solve a big problem for the marijuana industry. Although marijuana has been legalized either medically or recreationally in 32 states and decriminalized in most, cannabis businesses cannot open FDIC secured bank accounts because the federal government still categorizes marijuana as an illegal substance. As a result, the multi-billion dollar industry is run almost entirely on cash. Marijuana dispensaries often have to hire armored trucks to deliver hundreds of thousands of dollars in tax payments to state and local governments. Assembly member Phil Ting (D-San Francisco) is proposing bill AB 953 which would make California the second state after Ohio that allows cryptocurrency to be an accepted form of payment for cannabis-generated taxes. It is ridiculous that a multi-billion dollar industry is being left unbanked, leaving small business owners unable to perform basic financial operations and vulnerable to thieves due to dealing with large sums of cash.

In this Crypto News article from Cryptonews.com, third party digital payment processors like BitPay or Coinpayments, or even the use of stablecoins is outlined as a potential solution in effect as soon as 2020. If the law passes and we see a successful cryptocurrency payment process flesh itself out, cryptocurrency could finally become the widespread solution to the banking problem of the marijuana industry. In turn, adding the real-life utility of the marijuana industry could potentially add long-sought stability to cryptocurrency.

Image Source: https://disa.com/map-of-marijuana-legality-by-state

What is the best solution?

If cryptocurrency so obviously bridges the gap in the marijuana payment and tax process, why hasn’t it been more heavily utilized already? In all states except Ohio, it’s not legal to pay your taxes with cryptocurrency, but that could change quickly since processors like BitPay and Coinpayments already exist to facilitate the trade. In fact, if employers were inclined, employees could accept their salaries in bitcoin today and choose to keep them as a digital asset or convert a portion to USD. Small businesses in the marijuana industry could accept payments, pay employees and even pay accepting vendors in cryptocurrency making their businesses more efficient than cash, more secure from thieves, and drive up the popularity of cryptocurrency among customers. So where does it breakdown?

Well, for a time, it was thought that the marijuana industry would adopt a coin designed specifically for them, and the charts show that HempCoin, PotCoin and the others have had big hype cycles. The problem is that those coins were designed specifically to pump and dump, and the industry suffered because of haphazard attempts at adoption of those coins. As the space has matured, consumers have gravitated back toward the major universal currencies like Bitcoin, Dash, Litecoin and Monero for payments.

Many are quick to blame volatility as the sole culprit behind lack of mass adoption. But top analysts at Crypto Traders Pro believe this is the wrong approach. Mass adoption is the SOLUTION to volatility. The problem within cryptocurrency today is that people are looking to “solve” the volatility problems through governance models that bring cryptocurrency away from its original design purpose. Rather than seeing cryptocurrency as a stand-alone innovative solution, they see it as fiat currency 2.0 or gold 2.0, a technology that only seeks to solve issues of transfer speeds or stability. Even so, conceptually this doesn’t sound like a problem – after all, the marijuana industry is seeking a solution that provides both transfer speeds/safety and stability. Yet, by seeking to remove the freedom of association within cryptocurrency, developers are inadvertently (or perhaps nefariously) creating systems of governance that allow for corruption and control by the few, making cryptocurrency an unattractive and unnecessary tool in the long-term. Their control-seeking behaviors ultimately repel third party developers, so while coins exist and are successfully traded, there aren’t sufficient ways for people to integrate cryptocurrency into their daily lives.

To put it simply, it’s not easy for customers to buy the things they want with cryptocurrency without it being a major headache for businesses. Cryptocurrency use should be a perk for business owners, offering blockchain-managed loyalty programs, rebates and facilitating trade much the same way credit cards have, but with more efficiency. While it’s common to see entire businesses run off of a tablet and a Square reader, cryptocurrency payments are integrated secondarily, and therefore only narrowly used in most cases. But with a little bit of development, crypto payments should be as easy as credit cards, but safer, faster, and cheaper, if not working out to be completely free (don’t forget, cryptocurrency is supposed to be an appreciative asset.)

How do we get from here to there? We need the emergence of a clear king of coins in the “retail payments” space. They need fast, reliable transactions, and the ability to deal with huge spikes in network volume without pricing out simple usage. That usage will reduce volatility and trigger increasing retail adoption. We also need developers to think like business operators and create viable point of sale and accounting tools that simplify the workflows of marijuana merchants.

When those tools get put in the hands of merchants, we will see values stabilize and steadily increase while solving the problems of centralized, legacy systems.

If you are a business owner looking to integrate cryptocurrency payments, leave us your contact information here! Crypto Traders is working on building a POS system with instant settlement and 0 fees!