Today’s CryptoTraders Pro news post is actually a blog piece by Adam, discussing how Bitcoin Leads the Way. Let us know what you think on our Facebook page! Do you agree that Bitcoin leads the rest of the market?

Introduction

The topic I’m going to discuss today might be commonplace for some people, but I feel like there is still a large group that doesn’t know how or why Bitcoin seemingly drags the entire market around with its moves. Plus, there are new people joining us in the crypto-sphere every day, so let’s dig right into it to understand why this is the case.

Have you ever wondered WHY the entire crypto market seems to follow Bitcoin? I know I sure did, and that also led to a lot of complaining with remarks like, “how come when Bitcoin goes up, my ___ coin goes down, and when Bitcoin goes down, my ___ coin goes also down!?”

Don’t lie, you’ve been there too, right?!

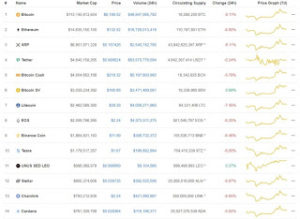

Here’s an image I took from today, the 21st of March, 2020. As you can see, every single coin (with the exception of Tether, naturally) is following the same trajectory as Bitcoin. Why?

Now, that’s not to say there aren’t times when some coins do the opposite of Bitcoin, but generally, during regular market movement this is what we see, especially for the top 100 coins/tokens. Have a look Here to read about the current market(s) drop.

Why does Bitcoin control the markets?

The answer to this question is actually very simple. It’s because of the way we perceive the USD value on our coins and tokens.

What do I mean, you ask?

Let me explain.

When you flip open your Coinmarketcap or Coingecko tab to go looking at cryptocurrency prices, you’re seeing their price valuation in USD, right?

Well, how do they determine the USD price of those coins and tokens?

They calculate the USD price of that coin or token by taking the current price of Bitcoin in USD, and multiplying it by the decimal version Satoshi value of it!

As of the image above, Bitcoin is priced at $6189.52 today. A coin with a price of 1,000,000 Satoshis, or decimal version 0.01 BTC would have a USD price of $6189.52 * 0.01 = $61.8952 USD.

Therein lies the problem with the cryptocurrency market. If today, Bitcoin dropped 10% and our imaginary coin worth 0.01 BTC stayed at exactly that same price in Satoshis, it too would automatically lose 10% of it’s value in USD.

Does that seem fair to you?

This stranglehold on the market can be frustrating. This also answers the question from the introduction of, “how come when Bitcoin goes up, my ___ coin goes down, and when Bitcoin goes down, my ___ coin goes also down!?”

When Bitcoin is going up, people sell their alt coins to Bitcoin or stables (Tether, etc) to try to ride the uptrend, thus lowering the coin or tokens value in Satoshis, often more than the price of Bitcoin has accrued. On the other side when Bitcoin is going down, as you’ve just seen, the price will naturally go down, even if the Satoshi value is unchanged, but even more so if the value in Satoshis is dropping as well. People sell their alts on the way down to try to pick up some cheaper Bitcoin as it falls.

Conclusion

For the time being, this is what we have to work with in the markets and that is why some traders focus solely on the price of Bitcoin. Interested in trading? Check out the Youtube series right Here

That’s also not to say that depending on TA (Technical Analysis) or FA (Fundamental Analysis) that a coin/token can go off and completely do its own thing, because quite often they do. It’s just that the general overall market cap of crypto is still at the mercy of the USD price of Bitcoin, and it will remain that way for the time being.

A lot of people really do want the day to come where there is an uncoupling of Bicoin from the rest of the market. Myself included. Right now though, Bitcoin is still the main trading pair on almost every single exchange there is and in some cases is the only way to purchase many alt coins.

Every asset should have it’s own valuation, one that can’t be manipulated by simply moving the price of Bitcoin, but until the day we don’t use Bitcoin to value the price of every asset in the market, we must learn how to maneuver with what we’re offered.