We’ve had some really promising news the last few weeks regarding the cryptocurrency market. We’ve had TD Ameritrade announce that they were investing in ErisX to offer cryptocurrency products, the CFTC confirmed that cryptocurrency is here to stay, and Bakkt is giving a way for Wall-Street to invest in cryptocurrency. We feel that all this is bullish news, and we’re seeing some great charts. But now, Bloomberg is reporting that bitcoin volatility is at its lowest levels for the last 17 months. Is this the beginning of the next bull-run for Bitcoin, or is this the start of Bitcoin’s death knell?

For those of you who are trying to predict where Bitcoin will go from here, technical analysis can only take you so far. Historical pricing patterns aren’t reliable – this type of pattern happened only one other time this year, in June, when the price jumped from $5900 to around $8200.

Nigel Green, founder of DeVere Group, a financial advisory organization, remarked on this low volatility, stating: “This could be a signal that the cryptocurrency market is maturing.”

Bitcoin turns 10 this month, but it took years for the cryptocurrency to gain legitimacy in the eyes of investors. It also struggled to attract individuals to consider Bitcoin’s payment network. Bitcoin and blockchain in general has undergone a trial by fire, now, as noted above, investors can’t wait to get involved with the cryptocurrency market.

Mike McGlone, a Bloomberg Intelligence commodity strategist noted: “This is a maturing market, so volatility should continue to decline. When you have a new market, It will be highly volatile until it establishes itself. There are more participants, more derivatives, more ways of trading, hedging, and arbitraging.”

David Tawil, president of ProChain Capital, agreed with the sentiment of Bitcoin’s volatility. Lower volatility shows lower liquidity which means a lack of momentum. The investors of Bitcoin now are “folks that are invested on a long basis for a long period of time”, he said.

Bitcoin’s potential to replace fiat currency and as an alternative for merchant processing brought real excitement starting in 2013 and 2014, leading to a massive bull-run that resulted in Bitcoin hitting $19511.00 in mid-December. But regulators have taken a sharper look at cryptocurrencies as well as rejecting proposals to list exchange-traded funds (EFTs) backed by Bitcoin. Mass adoption efforts have been curtailed, giving way to fears of manipulation over the price of Bitcoin.

There is one benefit to lower volatility, however, and that’s a decline in speculative investments in the market. Gil Luria, director of research at D.A. Davidson & Co. remarked how Bitcoin saw volume spikes from two sets of people – typical investors and speculators wanting to profit from its ups and downs regardless of its underlying value.

“Volatility and volumes are two sides of the same coin,” he said. “When speculators are involved, they drive unusually high volumes as well as volatility by trading the asset with high frequency. As speculator involvement is diminished, volumes go down and volatility goes down as well.”

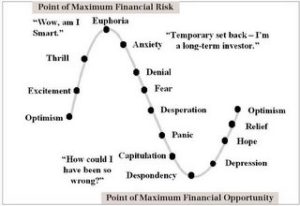

Naeem Aslam of TF Global Markets UK, had a more sober tone regarding Bitcoin’s low volatility and low volume, saying if volatility and volume both remain low, it means “capitulation”.

What do you think? Do you think this is a good thing or a bad thing? Do you agree with Aslam insofar as we’re at the capitulation stage of the market? Let us know on Facebook!